Blog

Published: March 08, 2017

Drill Baby, Drill - How the Permian Basin is Leading the E&P Resurgence in the United States

The natural gas and crude oil exploration and production (E&P) sector took a hit in 2016. A downturn in both gas and crude pricing, where both traded at prices not seen in more than...

Drill Baby, Drill - How the Permian Basin is Leading the E&P Resurgence in the United States

March 09, 2017

The natural gas and crude oil exploration and production (E&P) sector took a hit in 2016. A downturn in both gas and crude pricing, where both traded at prices not seen in more than a decade, coupled with ample storage inventories of both commodities pushed the E&P sector to the brink. The result was a reduction in drilling for both commodities and a run of downsizes, bankruptcies and mergers/acquisitions in the E&P sector. But as 2016 came to a close and commodity prices rebounded, drilling activity began to ramp back up and no play represented this optimism more than the Permian Basin.

The Permian Basin, located in western Texas/eastern New Mexico, is the largest crude-producing shale play in the United States. While drilling has occurred there since the 1920s, the introduction of hydraulic fracturing (fracking) and horizontal drilling turned it into a powerhouse. However, despite the proven abilities of the Permian, even it wasn’t immune to the downturn in drilling activity in 2015 and 2016. In January 2015 there were 480 gas- and crude-directed drilling rigs operating in the Permian basin. This number fell to a low of 137 rigs in May 2016. Luckily, E&P companies adapt quickly to low-price environments, gaining efficiencies in drilling operations while lowering drilling costs. To put it simply, these E&P’s learn how to do more with less and actual production was not impacted too severely during the collapse in energy prices, though growth was limited between mid-2015 and mid-2016.

While price increases certainly helped bring drilling back to the Permian in mid-2015, it was the announcements surrounding estimated reserves in two different fields within the Permian that really spurred the flurry of activity. The first came in early September when Apache, a large E&P based out of Houston, announced the discovery of a new field in the Delaware Basin portion of the Permian that held 75 Tcf (75,000 Bcf) of natural gas and 3 billion barrels of oil. Just for reference, the United States is forecast to produce approximately 26.9 Tcf of natural gas and 3.35 billion barrels of oil in 2017.

Two months later the United States Geological Survey (USGS), a part of the Department of the Interior, announced that they estimated that a portion of the Midland Basin, another area within the Permian, held an estimated 20 billion barrels of oil and 16 Tcf of natural gas. This is the largest estimated reserve of oil found within a single play that the USGS has ever surveyed.

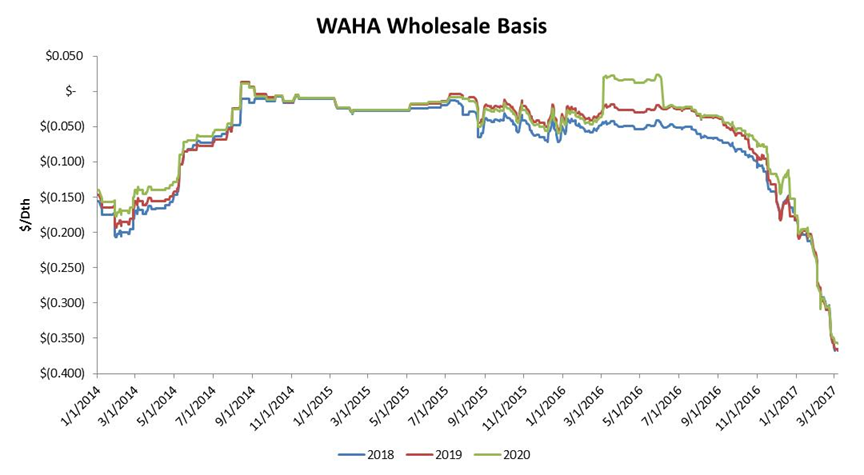

Drilling had already increased since bottoming out at 137 rigs in May 2016. As of August, just before the Apache announcement, there were 187 rigs operating in the Permian. There were 252 rigs working the Permian by the end of 2016 and 308 as of March 3, representing an increase of 150 rigs since March 2015 and 121 rigs since the end of August. Production, which lags increases in rig counts due to the drilling process, has also increased since mid-2016. Crude production was at 1.99 million barrels per day (MMbpd) as of May 2016 and gas production was at 6.95 Bcf per day (Bcf/d). March 2017 production is estimated at 2.25 MMbpd while gas production is estimated at 7.8 MMbpd. These increases may not seem significant, but forward WAHA basis, the natural gas basis point representative of the Permian area, shows a growing optimism that production will continue to grow.

Wholesale WAHA basis for the 2018, 2019 and 2020 strips has been on a free-fall since the two reserve announcements in September and November 2016. On September 1 2016, just before Apache’s announcement, the 2018, 2019 and 2020 WAHA strips were trading at -$0.068, -$0.038 and -$0.036 per MMBtu, respectively. All three strips had life-of-contract averages between -$0.04 and -$0.06 per MMBtu as of September 1, 2016. As of March 7, those same three strips were trading at -$0.365, -$0.368 and -$0.358 per MMBtu, all life-of-contract lows. And these lows came in the face of known demand growth across Texas from multiple sectors. LNG liquefaction, Mexican exports, new power generation buildout, and new industrial buildout will all increase demand in Texas. Not all demand will be fed by Permian production, but the continued move lower does speak volumes to the confidence traders have in the Permian’s growth potential.

The past several years haven’t been the easiest for E&P companies across the U.S., but the future is looking brighter. The Permian Basin, with its vast reserves of both natural gas and crude oil, will continue to help lead the way in this drilling resurgence.