Lessons in Power Deregulation: Montana

September 01, 2017

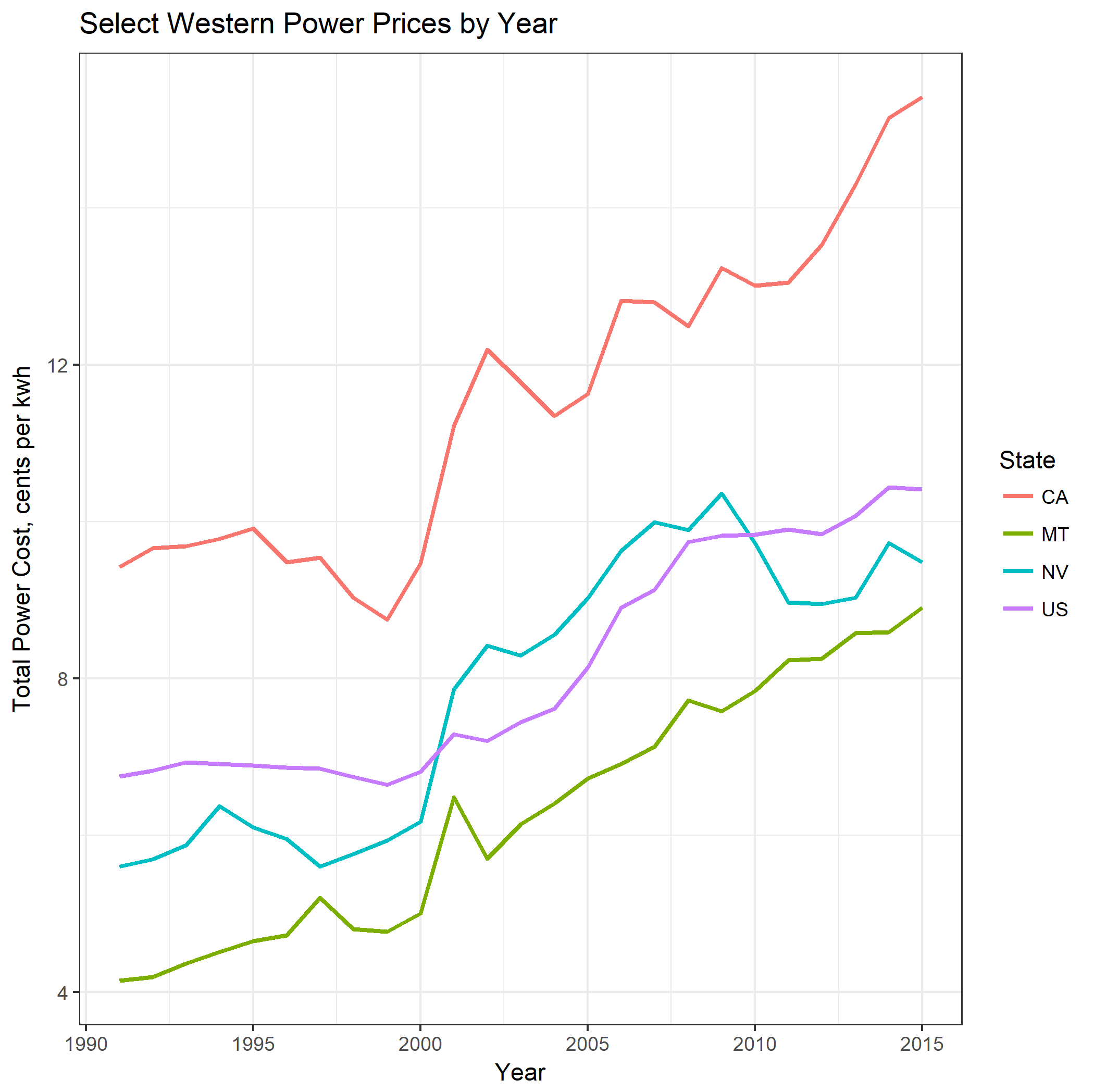

In recent months, there has been more talk around the creation of a new Independent Service Operator (ISO) in the western U.S., sparked by Nevada’s November 2016 preliminary vote to deregulate its electricity sector. Since then, the prospect of a deregulated Nevada has been cited by a number of groups that see it as key to fulfilling a variety of energy and environmental goals, namely reducing carbon emissions while also improving system reliability. In this context, it bears mentioning that Nevada and Montana both elected to deregulate more than 20 years ago and chose to suspend the process for a number of reasons. Of the two, Montana in particular offers lessons for those that wish to see a more deregulated U.S. electricity industry.

Montana voted to deregulate its electricity sector in 1997 with the signing of the Electric Utility Industry Restructuring and Customer Choice Act. The bill was supported by many including the chairmen of both the state’s largest investor-owned utility (Montana Power Company, or MPC) and Montana Resources, a copper smelting firm that was one of the state’s largest power consumers. Though Montana had inexpensive power already, there was the feeling that allowing more competition could drive prices even lower. Additionally, MPC felt that it could benefit from making corporate investments that were not allowed in traditionally regulated environments.

In July 1998, industrial customers were allowed to procure power from third party suppliers, beginning the process of deregulation. Later the following year, MPC announced that it was selling its entire generation fleet to PPL, a utility based in Allentown, PA. By early 2002, MPC had also sold its transmission and distribution assets to then little-known NorthWestern Energy and had rebranded as a fiber optic company known as Touch America. Touch America would be forced into bankruptcy in 2003.

During that time from 1998 until 2003, several events occurred that effectively ended the prospects for deregulation in Montana. First, the California Electricity Crisis of 2000-2001increased wholesale power costs across the West by severely restricting supply. Under MPC as it had existed, generation assets could have been deployed to shield the company from rising market costs. NorthWestern, however, the company responsible for delivering power to customers, had no generation and as such was forced to purchase power at inflated prices. Moreover, as part of the deregulation legislation, end user prices were still capped for those supplied by the utility.

Second, as prices began to increase, many of the first supply contracts signed in 1998 were beginning to expire and some of the contract holders returned to the shelter of NorthWestern’s price capped rates. This then forced NorthWestern into bankruptcy in 2003, though they would eventually be able to recover. At the same time, the Montana Legislature chose to delay full deregulation for residential and commercial companies, but decided not to delay the expiration of the price caps. While this did provide some relief to NorthWestern, it drastically increased rates for end users.

Ultimately, there was no choice but to abandon deregulation. By 2007, the Montana Legislature passed the Electrical Utility Industry Generation Reintegration Act which allowed NorthWestern to vertically integrate and restricted consumer access for all but the largest power loads. It was at this time that NorthWestern emerged from bankruptcy and announced plans to purchase MPC’s legacy generation from PPL.

There are numerous lessons to be learned here. The first is that deregulation in the power sector is not without risk. While the conventional wisdom of competitive markets is that increases in volatility will be met with overall price decreases, this is not always the case. Second, implementation is critical. As with some policy issues, large changes made over short periods of time can be problematic. Lastly, as the country begins new discussions on deregulation, the case of Montana is yet another reminder that every power market is unique. California’s electricity crisis ended full deregulation not only in that state, but also in Montana and Nevada. There are few other areas in which one state’s actions can have such a significant degree of economic impact on another market. As the talk around Nevada’s deregulation continues, these lessons should be carefully considered along with the potential benefits.