PJM Power Prices Are Down…A Lot

June 23, 2017

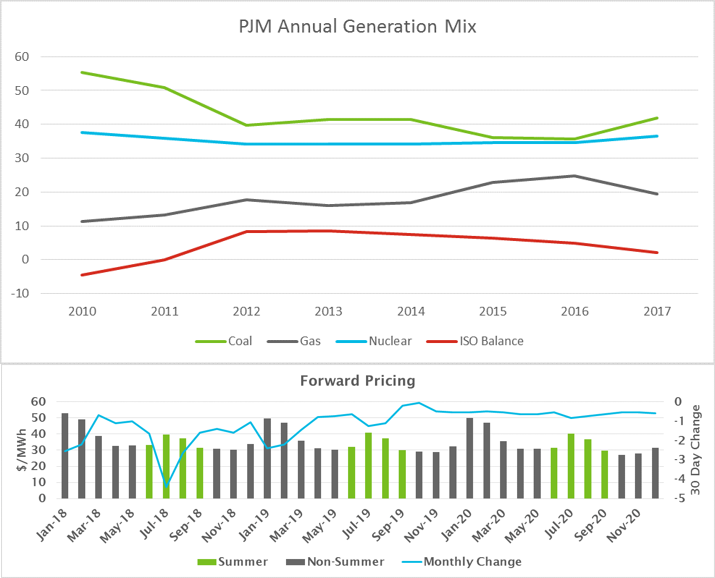

Power pricing in PJM is down. Since 2015, we have seen average prices for 2019 power drop from $45 per megawatt hour (MWh) to $35/MWh, with 2020 prices even lower than that. Moreover, in the last week alone we have seen near-term prices also drop, with the prompt-month contract falling 10% and pricing for the balance of 2017 falling by almost 5%.

So, what is causing this? Rather than thinking of the fall as one trend (i.e., “Power is getting cheaper,”) it is better to think of a two-fold cause: one is a larger macro-trend while the other is a seasonal micro-trend, although both are related.

In 2015, natural gas accounted for roughly 22% of PJM’s generation, up from about 15% only two years prior. By January 2016, that number had soared to 26%. This buildout in natural gas generation had two effects: first, it enabled the ISO to be self-sufficient in those times that the balance of resources that were not coal, gas, or nuclear (this would include imports, renewables, and oil generation) went from negative in 2010 – meaning that the ISO could buy external power for cheaper than it could produce it – to almost 5% in 2016.

Second, it tied the price of power in PJM closer to that of natural gas. Gas prices have traditionally been very important in wholesale power markets because most marginal generation (being that which is adjustable to meet changes in load) was gas-fired. Because of this, base prices were traditionally derived from coal pricing while the additional load that came from daily morning and afternoon peaks were dependent on gas pricing. Between 2010 and today, however, much of the coal generation has been replaced by combined cycle natural gas units that are marginally more efficient and run on now-cheaper natural gas. Additionally, during this time, the decrease in coal demand stabilized prices, meaning that counter cyclical pricing between the two commodities was no longer probable.

This macro-trend of increasing gas buildout leading to less expensive power was fueled largely by the shale revolution, much of which was geographically centered at the heart of PJM. This production boom has lowered national gas prices and then further lowered local pricing, resulting in spot market gas prices that can get as low as $0.60 per MMBtu in some areas.

Against this larger trend, there has been a more regional trend in which we have seen large decreases in pricing, especially in the near-term. Once again, this has been driven by natural gas prices.

On account of the extremely low pricing in the immediate regions around the Marcellus and Utica shale plays, there was a desire by producers to sell that gas in locations further afield to make more money. This necessitates a fairly large infrastructure buildout, most noticeably in pipelines. The thinking was that as more pipes were built, there would be less gas available locally, and this would increase pricing in the area to a degree but still keep it below the national price.

This has not happened yet, however. We have not seen a huge buildout in the area, meaning that local gas prices are still remaining low. Additionally, due largely to milder weather, overall power generation from gas is down for the year (for the first half of 2017, natural gas use in the power sector as a percentage of total demand was on par with 2014 levels), and a greater percentage of generation than ever before is being met by no-marginal cost renewable resources. Because of this, the low local cost of gas, and also lower-than expected loads, we have seen a substantial drop in prices for this summer and next, with many of the intervening months lower as well.

This is, of course, fully dependent on loads remaining low. Power pricing in PJM is largely a function of local gas prices and local loads. If loads do materialize as we are expecting this summer, then this pricing, especially for the summer months, could increase significantly.