Blog

Published: March 19, 2018

What's Up With Texas Power? (Other than the Cost)

Summer power is always more expensive in Texas. This is not surprising as ERCOT, the corporation that runs the power grid for most of the state, has eschewed a capacity market and instead allows price spikes to compensate occasional generation.

What’s up with Texas Power? (Other than the Cost)

March 19, 2018

Summer power is always more expensive in Texas. This is not surprising as ERCOT, the corporation that runs the power grid for most of the state, has eschewed a capacity market and instead allows price spikes to compensate occasional generation. Historically, this has led to some of the lowest prices in the country, though when prices increase, they can do so quickly and dramatically.

How did this happen?

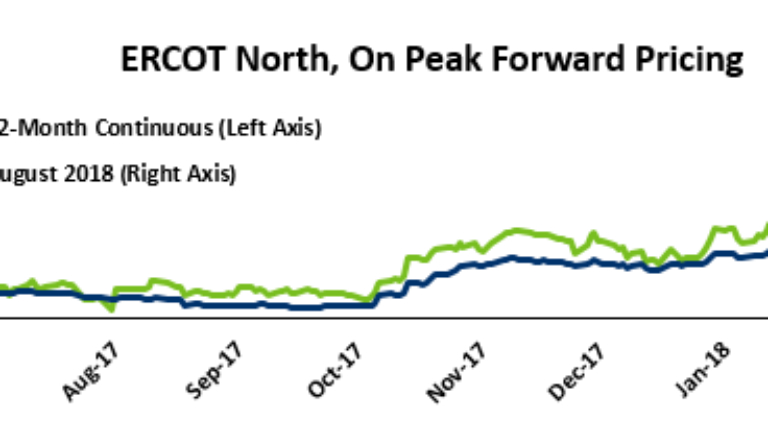

The fact that we are currently looking at forward pricing for August 2018 of almost $200/MWh is not incidental. This came about after a series of market shocks occurred in succession, with little time for the prices to normalize before the next hit.

This process all started with the announcements, made over several days, that Luminant Generation was closing 4,200 MW of coal-fired generation. All of these facilities were built between 1971 and 1981 (save a single boiler added to one plant in 2010) and in 2017 operated at between 50% and 90% of their optimal capability, compared the national average that year of 53%. They were retiring due to overall low power prices in ERCOT and were no longer economical to operate, according to Luminant.

Forward prices increased on this news, especially in the month of August, which typically sees the highest demand of any month and is more likely to see price spikes. Over approximately three weeks, August pricing jumped from $59/MWh to $87/MWh as the traders and markets rationalized the implication of losing that much generation. Eventually prices peaked at $91/MWh before they started to recede in November.

December then brought another, smaller, shock. A NERC long-term reliability assessment quantified the impact of the Luminant retirements, lowering ERCOT’s reserve margins (that amount of generation in excess of the forecasted peak) from 18% to less than the recommended 14%. This did not cause prices to increase as the retirement announcements had, although it did stop the downward movement of forward prices.

January then brought colder temperatures and near-record demand. Three times over the month ERCOT set new winter demand records, since most of the heating in the region is powered by electricity rather than gas. By the end of the month, the ISO had seen a winter demand that rivaled some summers and, more importantly, had seen prices top out for the first time at the astronomical $9,000/MWh price cap for several 5-minute periods. Forward prices for summer and winter surged on this news, as this was more volatility than had been seen in the region in some time. By the end of January, August 2018 forward pricing stood at $110/MWh.

By late January, forward prices began to stall once again, with the 12-month strip moving to the downside as February rolled off the board. The August 2018 contract traded flat in this time as well as no news came out to push the price upward or downward. This changed on February 19th, when a member of the state Public Utility Commission stated that “We are going into a summer where people are going to be paying a lot, potentially paying a lot more,” and “We are not really sure what we are going to see.” On this news, August prices jumped $40/MWh to $161. These comments were followed only a few weeks later by the release of a preliminary summer resource adequacy report that indicated reserve margins of only 6.4%, half of the 13.75% that is considered ideal. This pushed prices to as high as $194/MWh.

Are these Prices Realistic?

These forward prices are extremely high. August is typically the most expensive month of the year in ERCOT, though over the past several years this contract has been overpriced at $50/MWh, with monthly cash prices averaging $29 and $33/MWh over the prior two Augusts. Still, when considering a $30/MWh “average price,” $200 for a monthly average only means 6-10 hours of price spikes. According to a 2016 document published by ERCOT that outlined the impacts of various scenarios, ten hours of price spikes is not unrealistic for the closure of several thousand megawatts of coal-fired generation before 2020.

In spite of that, we have seen the price of the August contract fall slightly in recent days, a time of year when it is usually beginning to rise. This could be corrective or represent only a small respite before additional news drives it higher.