On the DOE Wholesale Electricity Markets and Reliability Study Report

September 07, 2017

Last week, the U.S. Department of Energy (DoE) released its anticipated study on wholesale electricity markets and reliability. Commissioned by Energy Secretary Rick Perry, the report examines if state augmentations to markets are threatening grid reliability. This massive, 187 page document takes its time to delve into several generation methods and look at how they are evolving under our present period of low natural gas prices. While the report has many findings –as is evidenced by the thirteen page summary at the beginning- three stand out:

- First, while environmental regulations have contributed to the closure of coal-fired generation, low natural gas prices and improvements in generation technology are responsible for most closures.

- Second, as the penetration of intermittent, mostly renewable resources increases, the U.S. power grid will need to become more agile

- Third, wholesale markets are currently being utilized to accomplish tasks for which they were not designed.

The first is without doubt the most controversial and has its roots in statements made by Secretary Perry himself, who has questioned if federal and state regulations are eroding grid reliability. Citing the massive closure of coal generation facilities prior to the implementation of the Mercury and Air Toxics Standards (MATS) in 2016, the report does not shy away from saying that these regulations have indeed contributed to the closure of plants. However, the report then goes on to demonstrate via several measures that the plants closed in the run-up MATS coming into effect were likely already those that were economically struggling.

According to the report, most coal-fired facilities retired between 2010 and 2016 were older, smaller in capacity, and utilized less than their counterparts due to economic reasons. Significantly, the majority of facilities retired during this period were utilized for less than half their rated capabilities as they were uneconomical to run the majority of the time. The average age of the retired plants was more than 15 years older than the age of those plants that were not retired and their retirements were likely planned as none of them contained any control measures for SO2, a greenhouse gas associated with coal generation.

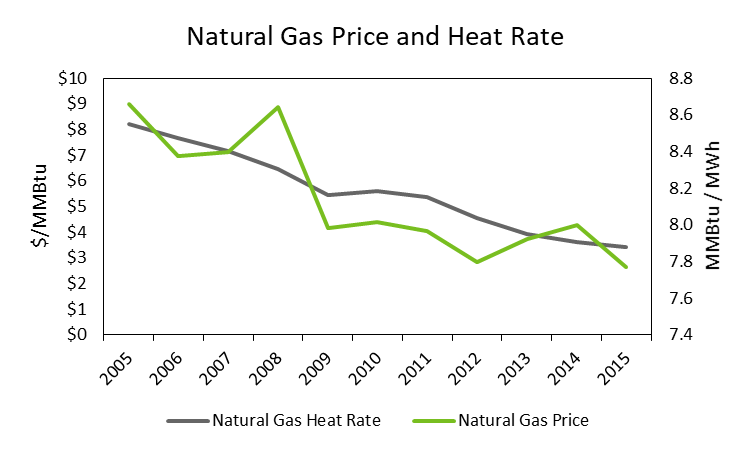

Against this backdrop, there are two forces that were working to increase the role of natural gas in power generation: costs and efficiency. Historically, natural gas prices were much higher than today’s prices and substantially more volatile. This all changed with the “Shale Revolution” of 2008 when natural gas prices began to decrease quickly. At the same time, innovations in generation technology made natural gas methods, most noticeably combined cycle generation, more efficient, requiring less gas to make the same amount of electricity. Together, these trends took the average cost to generate one megawatt of power using natural gas from $76.84 in 2005 (unadjusted for inflation) to $20.68 in 2015.

These points taken together paint a somewhat more nuanced picture of coal retirements than is usually presented: older, smaller, and less efficient coal plants were already losing market share to newer natural gas power generators. Simultaneously, regulations that would require substantial investments be made into the already uneconomic coal facilities began to come into effect, making the closure of these plants an easy financial decision.

Second, the report points out that given current trends, there will have to be substantial changes made in how we think about the U.S. electrical system. As the use of zero-marginal cost, non-dispatchable generation (that which has no fuel and cannot be controlled, like wind and solar) increases, the need for more agile resources increases as well. This is already being seen in areas like California where the heavy reliance on longitudinally distributed solar generation causes demand fluctuations that are difficult for generators to respond to.

In effect, the report forecasts a change from a baseload system wherein some resources run constantly and others are added in waves to an intermediate load system wherein dispatchable resources actively cover the difference between non-dispatchable supply and end-user demand. Under an intermediate load system, cost to operate is a consideration as is the rate at which a generator can change its output. This is controversial, as it puts traditionally non-responsive baseload resources like coal and nuclear generators at a disadvantage.

The report does not, however, discuss how to move from our present baseload system to this forecast intermediate load one. It does bring up creating market incentives for both flexible demand as well as flexible load, however these are not examined carefully. Additionally, it does make several warnings as to the necessity of not retiring traditional baseload resources too quickly or in response to market conditions that may not be sustained.

Lastly and most interestingly, the report affirms that wholesale electric markets were established with two goals in mind: to procure power reliability and at low prices. To this end, the DoE and subsidiary groups like FERC take great pains to keep these markets fair while responding to changing market conditions. These markets are, however, being utilized to some extent to accomplish a number of other goals like job creation and emissions reduction. To this end, the report again does not propose solutions, but indicates that if these goals are not priced into the market in some way there are risks to both reliability and price. It does link to a separate paper in which former FERC chairperson Tony Clark discusses some alternatives but makes no comment on Clark’s thoughts.

While the future structure of the U.S. power grid and the markets that support it are up for debate, the DoE’s latest report attempts to allay fears of an inevitable reliability crises while calmly pointing out potential cracks in our system and possible future paths down which we might go. Many industries, from coal generation owners to green-tech groups, found sections in the report to praise, though its true value will be in the conversations that it can spark amongst regulators and lawmakers.