The Triad of U.S. Natural Gas Demand Growth

April 21, 2017

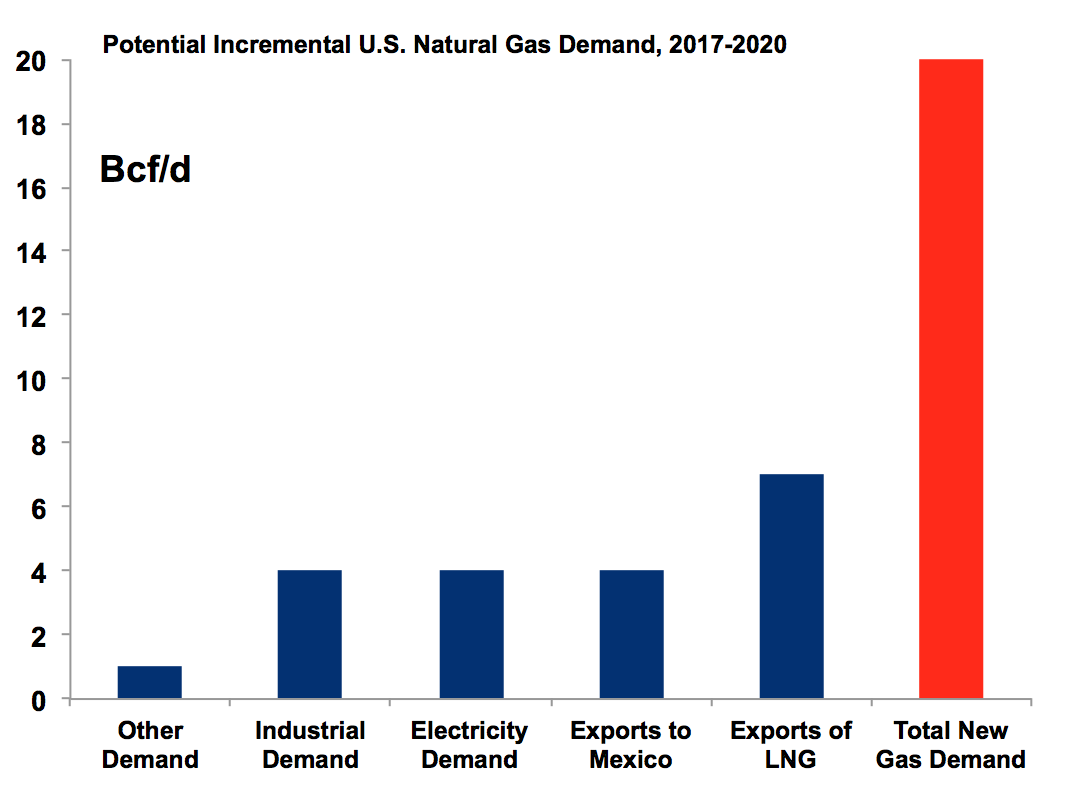

Thanks to a shale production boom, falling prices, and its cleaner burning and versatile nature, there has been a rush to utilize natural gas in the United States. Looking forward, there are three sectors that will significantly increase demand: power generation, industrial growth, and exports. In total, U.S. gas consumption could grow over 25% to ~95 billion cubic feet per day (Bcf/d) by 2020.

1. Power Generation

Since 2000, approximately 75% of new generating capacity in the U.S. has been gas-fired. Now at about 450,000 MW, gas accounts for 43% of total U.S. capacity. There is currently 90,000 MW of new gas-fired generating plants expected to come online over the next four years alone.

Already with over 20,000 MW retired in the past two years, the median-aged coal plant in the U.S. was built in the early-1970s. And quietly, about 1/3 of U.S. nuclear plants are near their mandatory retirement age, facing the end of 40-year operating licenses. In other words, as the country’s nuclear and coal fleets continue to age, the gas-fired generating fleet is getting younger and gaining market share.

With high efficiency rates, lower costs, and faster build times, over 60% of new generating capacity build-out will be combined cycle natural gas plants, according to projections from the U.S. Department of Energy. In 2016, gas generated 34% of U.S. electricity and surpassed coal to become our primary source of power generation.

2. Industry

Industrial heavyweights seek a “manufacturing renaissance” built on a massive low cost gas resource base that gives them a competitive advantage globally. Industry wants to use cheaper ethane derived from natural gas to replace higher cost naphtha from petroleum.

Industry uses gas as a fuel and/or feedstock to meet numerous energy requirements, making chemicals, plastics, and other everyday products. The U.S. will also become the global leader in ethane exports (along with propane, the most abundant liquid contained in the natural gas stream), with capacity surging from almost nothing in 2013 to more than 450,000 b/d by 2018.

To illustrate, Shell's new $6 billion ethane cracker 30 miles northwest of Pittsburgh will break gas down into smaller molecules to create ethylene and polyethylene for plastics manufacturing. The plant is expected to be completed in 2022 and will be fueled by gas sourced from the Appalachian Basin, the lowest-cost shale gas basin in North America. Pittsburgh is ideal because it lies within a 700-mile radius of nearly 75% of all North American polyethylene customers. IHS Markit finds that the area could support at least four additional crackers

3. Exports

U.S. gas exports are perhaps the biggest demand side factors that could impact prices. With actual deliveries already at 4 Bcf/d, piped capacity to Mexico will double to 15 Bcf/d by the end of 2018. Natural gas now accounts for almost 60% of Mexico’s power generation, well more than double the OECD average. Relying on proximate, low cost U.S. shale gas is a strategic choice to meet the needs of Mexico’s emerging economy. By 2020, Mexico is expected to import about 75% of its gas demand from the U.S., up from 55% today.

Yet, the largest potential export market for the U.S. is the rapidly growing liquefied natural gas (LNG) trade, which involves cooling natural gas into a dense liquid to make it easier and cheaper to ship. With lower prices, flexible contracts, a stable democracy and legal system, and an ample supply of technically advanced companies, the U.S. has already exported LNG to some 20 nations since operations began in February 2016. The U.S. is slated to have the capacity to export at least 10-12 Bcf/d of LNG by 2020, or about six-fold from what we have now.