Improve Energy Efficiency

The IRA extended and expanded the Commercial Buildings Energy-Efficiency Tax Deduction, which supports major energy efficiency retrofits to buildings at least five years old. To be eligible, interior lighting, HVAC, water heating, and the building envelope upgrades must decrease building energy use intensity by at least 25%. The deduction ranges from $0.50 per square foot to $5.65 per square foot (as of 2024), depending on the magnitude of the energy reduction and whether the project adheres to prevailing wage and apprenticeship requirements. Computer modeling and verification that the project meets energy efficiency requirements is required for this tax deduction, so the retrofit plan must be designed by a professional.

Adopt Renewable Energy

Building owners have options for claiming tax credits for the adoption of renewable energy sources. These credits phase out as we move closer to 2032 or the year in which national greenhouse gas emissions from electricity production are 25% or less than the emissions from electricity in 2022, whichever comes first.

Credits based on the renewable energy installation investment include:

- the Investment Tax Credit for Energy Property (for projects that begin prior to 2025)

- the Clean Electricity Investment Tax Credit (for projects that begin 2025 and later).

Tax credits based on the amount of energy produced include:

- the Production Tax Credit for Electricity from Renewables (for projects that begin prior to 2025)

- the Clean Electricity Production Tax Credit (for projects that begin 2025 and later).

Either a production credit or investment credit can be claimed – not both. As of 2024, the Clean Electricity Investment Tax Credit provides a credit ranging from 6% to 70% of the cost of the renewable energy system. The Clean Electricity Production Tax Credit entitles building owners to a credit worth up to $2.75 per kWh of energy generated that is sold, consumed, or stored. In either case, the exact amount of the credit depends on the size of the energy system, whether prevailing wage and apprenticeship requirements are met, whether the project is located in a so-called energy community, and whether the materials used in the project meet domestic content requirements.

Install Energy Storage

The Investment Tax Credit for Energy Property can be applied to energy storage technologies such as batteries and thermal energy storage systems, with or without renewable sources, such as solar or wind. When adequate storage is used with an appropriately sized renewable energy source, facilities can operate with zero-carbon electricity 24/7. Even without on-site renewable power, standalone energy storage systems are eligible for the tax credit and can be used to store energy from the grid when demand is peaking and energy costs are high.

Install EV Charging

The Refueling Infrastructure Tax Credit provides incentives for installing EV charging infrastructure in non-urban and low-income areas between 2022 and 2033. The credit ranges from 6% to 30% of the cost, depending on whether the equipment is subject to depreciation and whether prevailing wage and apprenticeship requirements are met.

Make Decarbonization a Sound Financial Choice

The IRA allows a five-year period for the modified accelerated cost recovery system depreciation method for select technologies, which allows for a greater depreciation deduction early in the life of the equipment. For example, when the Clean Electricity Investment Tax Credit is claimed, the cost of the renewable energy and/or energy storage system minus one-half of the tax credit can be depreciated.

Businesses can sell or otherwise transfer credits derived from the Clean Electricity Production Tax Credit and Clean Electricity Investment Tax Credit. Selling or carrying forward tax credits can be attractive to companies that have low or no tax liability and would otherwise not be able to realize the full financial benefits of the credits.

The IRA also provides funding to numerous state-administered grant, loan, and rebate programs, many of which apply to commercial and industrial buildings. The IRA appropriated:

- $5 billion in Climate Pollution Reduction Grant funding to advance local climate action and building performance improvement mandates, as well as funding to help buildings owners retrofit buildings to meet compliance requirements.

- An estimated $300 billion in public-private investment in community decarbonization through building retrofits and zero-emissions transportation through the Greenhouse Gas Reduction Fund

- Over $6 billion to help manufacturers modernize industrial facilities to improve efficiency and reduce greenhouse gas emissions

- $50 million to improve indoor air quality in schools through building modernization

Increase Decarbonization Ambitions

The financial incentives provided by the IRA can be substantial. For organizations with ambitious environmental goals, money that would otherwise be used to pay taxes can be redirected to further facility improvements. For instance, a one-million-dollar solar generation and energy storage installation that is eligible for a 40% tax credit could fund a “bonus” $400,000 HVAC upgrade on the site. If that HVAC retrofit adequately reduces energy consumption, the project would qualify for an additional tax deduction benefit. The resultant tax deduction could be applied to additional decarbonization initiatives, such as staff training, stakeholder outreach, or the installation of EV chargers. When well planned, IRA credits and deductions can be cascaded in this way to expand the scope of decarbonization plans.

Overcoming Eligibility Complexities

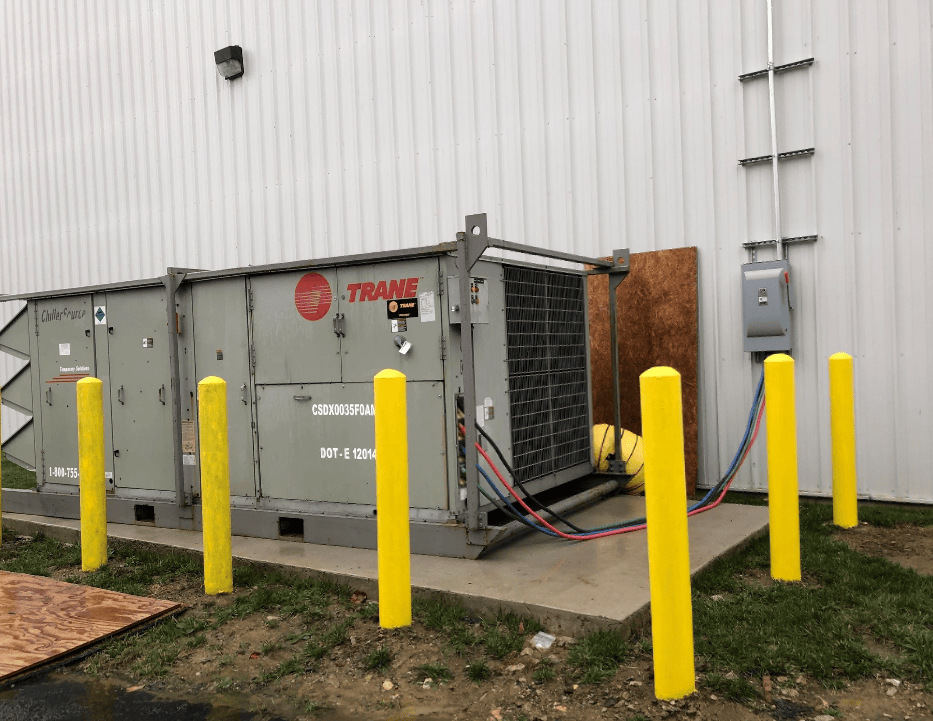

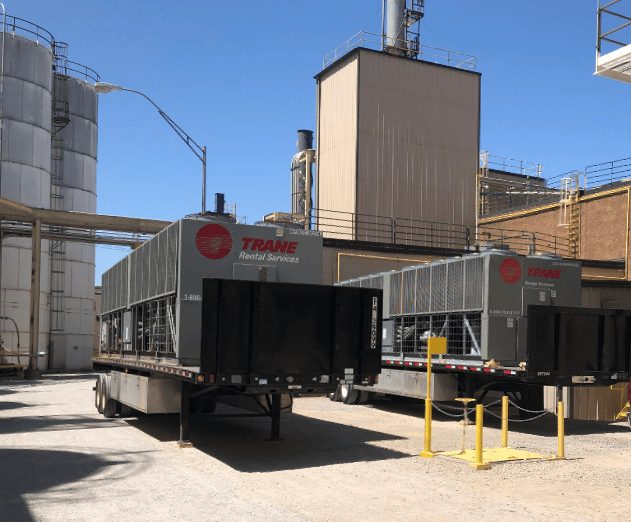

Navigating the dynamic eligibility requirements of IRA-modified tax incentive programs is complicated. Every project must be designed, constructed and measured to verify incentive eligible improvements have been made and intended outcomes have been achieved. Moreover, many projects that qualify for these federal tax incentives simultaneously qualify for local utility incentives that require the same technical support – a two-fold financial benefit that can make these projects more affordable. Working with a building expert, such as Trane, to design and install building improvements that are eligible for these expanded incentives is one way building and business owners can ensure they capture their maximum value.

DISCLAIMER: Trane does not provide tax, legal, or accounting advice. This material is for informational purposes only and it should not be relied on for tax, legal, or accounting advice. Tax law is subject to continual change. All decisions are your responsibility, and you should consult your own tax, legal, and accounting advisors. Trane disclaims any responsibility for actions taken on the material presented.