The Relationship Between Oil and Natural Gas Prices?

June 28, 2017

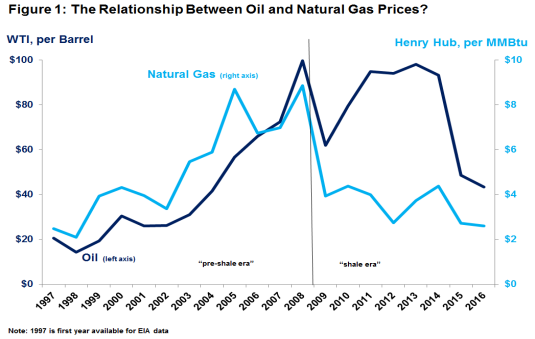

The link between crude oil and natural gas prices is critical for end-users: these two sources are increasingly being produced by the same companies and together supplied 70% of U.S. energy demand in 2016. To set the context, Figure 1 demonstrates oil and gas prices since 1997.

The Revolution of Oil and Gas Prices

Oil and gas production in the U.S. has been revolutionized by the widespread deployment of hydraulic fracturing and horizontal drilling technologies to release hydrocarbons from tight shale formations. In turn, for the past two decades, there have really been two different eras for U.S. oil and gas: the “pre-shale era” (1997-2008) and “shale era” (2009-present).

Oil and gas prices have clearly become de-linked in the “shale era”. This is because natural gas is a regionalized product, so surging domestic production has really helped lower U.S. prices more so than surging domestic oil production has, because oil is a global commodity. Some other key points that we can gather from these two different eras for oil and gas prices:

- The oil and gas price disconnect is measurable. The correlation coefficient between oil and gas prices in the pre-shale era was 0.90, compared to 0.54 in the shale era. Although not a cause-and-effect indicator, this coefficient does help indicate how much similarity (rise/fall together) exists between the price patterns of oil and gas. In the pre-shale era, oil prices averaged about 8 times higher than natural gas, but in the shale era, oil has averaged 22 times higher.

- Demand wise, one reason for the previously strong connection between oil and gas prices was that they have been close substitutes for each other through the years, particularly in electricity generation and industrial uses. This would suggest that higher oil prices would increase gas demand and price, and vice versa. Although this fuel substitution should continue in industrial and some transportation uses (e.g., heavy diesel trucks switching to natural gas), it is no longer a major trend because oil’s role in power generation today is insignificant, whereas electricity generation is now natural gas’ main demand sector – at about 35% of all usage.

- As for production, higher oil prices can actually help lower gas prices. That’s because higher oil prices usually mean more field activity and more associated gas production (gas produced as a byproduct of oil). For example, now producing 8.5 Bcf/d, the Permian Basin in West Texas is our second largest gas field (after Pennsylvania’s Marcellus), despite the fact that it has no gas-directed drilling rigs. In the reverse of course, lower oil prices can therefore help increase gas prices by lowering gas production.

Given the “global-ness” of oil versus the “regional-ness” of gas, oil has a higher tendency to affect gas prices rather than the vice versa. Oil markets are more established, have larger traded volumes, and are internationally linked due to the ease of transporting oil. Nearly 70% of all oil consumed is traded among nations, versus around 30% for gas. Natural gas is generally sold along three markets where prices can vary greatly; Asia, the Americas, and Europe. In contrast, there is effectively just one market for petroleum.

Yet, increasing exports of U.S. liquefied natural gas (LNG) will continue to gradually change our oil and gas price relationship. The LNG trade is expected to grow dramatically in the coming years, which will make gas more of a global commodity like petroleum. And as the U.S. becomes more involved in selling LNG, geopolitical influences could have more of an influence on domestic gas prices, just like they do for oil. In short, consumers should know that the days of U.S. natural gas market isolation are slowly fading.