Hurricanes Harvey and Irma and the Impact to Natural Gas Prices

September 20, 2017

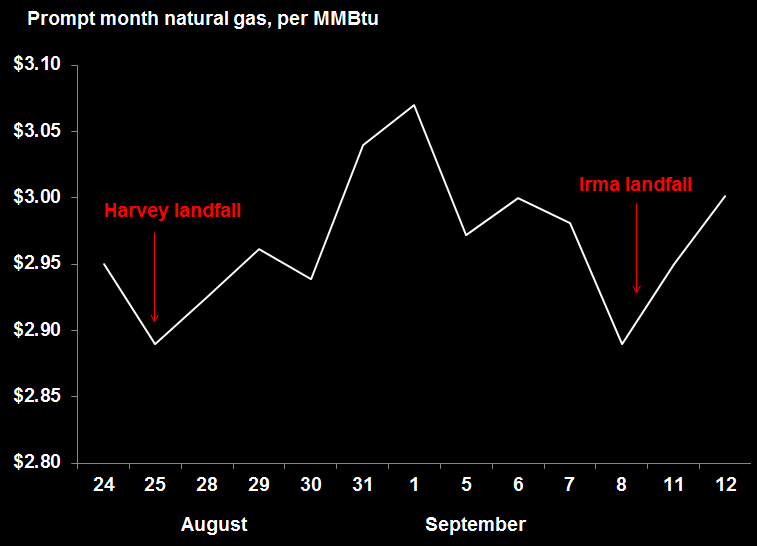

The impact of Hurricanes Harvey and Irma on natural gas prices was mostly muted. In fact for futures contracts, on Friday August 25, right when Harvey's Texas landfall was imminent, prompt-month September natural gas actually dropped $0.06 per MMBtu on the day to settle at $2.89. For comparison, Hurricane Ike, the last hurricane to hit the Gulf producing area in September 2008, resulted in a jump of over $1.00 per MMBtu from the week before the hurricane hit through the week after it made landfall.

The impact of Harvey on U.S. gas production was also limited. The Gulf of Mexico now accounts for just 3-4% of total output, compared to over 25% in 2005. On the Saturday of Harvey’s landfall, U.S. production slightly dropped to 72 Bcf/d but had rebounded to 73 Bcf/d by the following Friday. As for Irma, Florida and the impacted neighboring southeastern states aren’t significant gas producers.

Given the “demand destruction” from power outages and flooding, it's no wonder that Harvey and Irma didn’t impact gas prices. In particular, depressed demand across the Gulf region including Florida is bearish for gas pricing. Texas (10.7 Bcf/d), Florida (4 Bcf/d) and Louisiana (3.7 Bcf/d) are 1st, 3rd, and 4th respectively in gas demand this time of year. Having a combined 50 million people, over 50% of Texas’ power generation is fueled by natural gas, while Florida generates approximately 67% of its electricity via natural gas.

For Harvey in Texas, there were 300,000 consumers left without power at the peak of the outages. Florida Power & Light, the state’s largest utility, reported that around 9 million people lost power during Irma – almost half of the state. And in the Carolinas, Irma left almost 300,000 without power.

Especially in Florida, damage from Hurricane Irma would have been a lot worse were it not for billions of dollars spent on storm-hardening measures over the past decade. Total gas demand in Florida, Georgia, Alabama, and the Carolinas still dropped more than a third to 6.2 Bcf/d between Thursday and Sunday, the day Irma hit the region.

Moreover, adding to the demand destruction, LNG feedgas and piped gas to Mexico dropped to yearly lows during Harvey. Interestingly, despite some lower reduced consumption in the Gulf, U.S. industrial gas demand, the second largest source of demand after power generation, stayed in the very tight 20-20.5 Bcf/d range during the hurricanes.

For gas prices going forward, this decreased demand could lead to larger-than-normal storage injections in the coming weeks, potentially bearish for near-term pricing. For example, for the week ending September 8, we had a massive 91 Bcf injection compared to the 5-year average of 63 Bcf.

In the future, Gulf Coast storms are expected to be even more bearish for gas prices via the demand destruction we witnessed during Harvey in particular as compared to the bullish sentiment seen in reaction to past hurricanes. By 2020, the LNG export capacity in Louisiana and Texas will triple to more than 8 Bcf/d. The Gulf will be the center of a U.S. LNG business that accounts for 15-17% of global demand by 2021, up from 1-2% in 2016. In addition, U.S. exports to Mexico could double to 9 Bcf/d by 2022. All-in-all, more and more demand will be impacted by Gulf Coast storms in the coming years, further adding to potential demand destruction.

Gulf Coast hurricanes used to be a major fear in U.S. natural gas markets, but Harvey and Irma showed how the shifting of natural gas production from the Gulf Coast to areas like the Marcellus and Utica shales has completely changed the dynamics of how hurricanes impact gas prices.

Trane and the Circle Logo are trademarks of Trane in the United States and other countries.